We're seeing Wall Street rally over the past month, gaining much of what was lost in previous months.

Looks good eh?

Unless you pick up the front sheet of mainstream media and peek underneath where you will see masses of workers continuing to be thrown out of work, industrial machinery continues to rust, trade and overall growth continues to show alarming evidence of an abyss.

The bailouts seem to be working if you watch the recent gyrations on the stock markets. American Treasury Secretary Tim Geithner has calmed investors fears by making it clear that the American taxpayer will bail out their worthless assets and will buy them at inflated prices. Private stockholders have reacted. When Geither announced this bonanza (that he would be dumping massive container ship loads of tax dollars into their pockets and that it is secure) private capitalists reacted and drove the Dow Jones back up over the 8,000 mark. The value of worthless assests was restored for private capitalist money changers.

Obama has been meeting with the cream of the capitalist crop and taking direction from them. He is doing a good job for them and they are happy with his so called 'change'.

They will also make Obama cut what's left of America's crippled social programs to the bone. The plight of the average U.S. citizen is exacerbated by the already tattered social safety net. Times were bad, they are going to get much worse. Demands will also be made to cut social services in Canada, the UK, and Europe. What's good for capitalists is not good for the rest of us and vice versa.

The illusions playing out before your eyes, now, are just that, illusions. Capitalists are not going to tolerate heavy market regulation and although the gods of reason and logic demand it, these gods are not working in the interests of monopoly capitalism. Off with their heads. "The Financial Accounting Standards Board, which determines what rules U.S. companies must follow when adding up their numbers, has relaxed requirements that forced financial institutions to account for massive paper losses stemming from possibly temporary damage to assets caused by the credit meltdown. Critics say the easing of mark-to-market rules allows the banks to play fast and loose once again with asset values. Advocates of the reform say it's ludicrous to force institutions to value securities at current distressed market prices if there's no actual market for the stuff." (Brian Milner - Globe and Mail)

http://business.theglobeandmail.com/servlet/story/RTGAM.20090403.wtakingstock0404/BNStory/robColumnsBlogs/home

A gutsy and honest bank analyst named Meridth Whitney warned investors to sell in November. She could see what was coming. And she isn't being fooled by the recent jump in Wall Street numbers. She said that available credit to consumers in the US will shrink by about 55% in the next two years. “Since 2006, you've had liquidity coming out of the market. That's caused consumer credit to worsen. Liquidity continues to come out of the market. Therefore, consumer credit continues to worsen,” ... “The assets on bank balance sheets are worth less and less. And they need more and more capital.” - Meredith Whitney (Globe and Mail April 3)

It is worth noticing that the Financial Accounting Standards Board is weakening accountability mechanisms as the capitalists demand. This, in the face of the horrendous consequences resulting from deregulation and market anarchy. They have weakened market to market accounting rules and this will allow the banks to value their worthless assets as they wish.

The same smoke and mirrors chicanery that held the value of assets at inflated rates is still in place. Voodoo economics continue to massage our worries away, telling us that everything is okay. Our capitalist rulers have everything under control. And, as before, the mainstream media and the politicians continue to do Wall Street's malignant bidding.

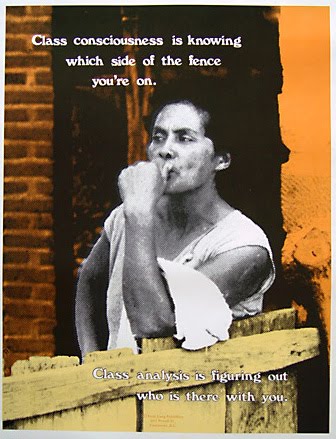

Meanwhile, a massive rift is becoming apparent. On one side sit the fat cigar smoking con men with the politicians and their armies of media whores and beggars in suits and on the other side, here sit the rest of us. They are simply taking our wealth away through the power of the politicians and telling us that if we are lucky, they might loan it back to us at 18% interest. Class war is on. They, on that side, know it. We don't.

The world has turned upside down. Wealth is what you see before you and around you. Wealth is not money. Wealth is stuff. Stuff is real, money is an illusion. When this reality is understood, we will stop believing that wealth emanates from the wealthy class. The wealthy class merely exploit, manipulate, and steal to gather their wealth. Contrary to popular belief, these people don't earn it, they manipulate it. Their power rests in an agreed upon illusion; capital. In reality however, all wealth is created through the processes of taking material from the ground and fashioning it into 'stuff'.

We can do that. We do do that. We don't need the parasites to encourage us.

Wealth is cars and shirts and copper ore. And it is you and I that transform rocks and materials into valuable commodities.

Upside down thinking makes us believe that we need the shysters to make copper wire, cars, and shirts. That wealth depends on capital. And that is why we are mute when Obama and the rest of the groveling errand boys ship containers full of tax dollars over to the other side of that nasty rift.

We have learned to see the world through the eyes of the class that are on the other side of that rift. We have to stop depending on them. The sooner, the better.

No comments:

Post a Comment